Floyd Mayweather and Cryptocurrency

If there is any entertainer in the world who would be super careful to promote cryptocurrency projects, coins offering, it would be none other than the biggest sportsman in boxing history Floyd Mayweather.

Table of Contents

How well do you know Floyd Mayweather?

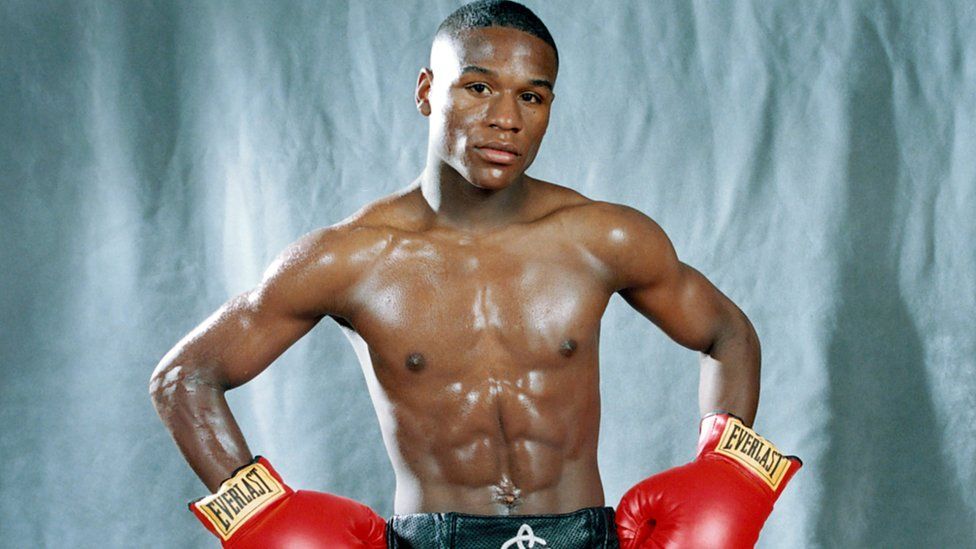

Floyd Mayweather Jr is an American professional boxing promoter, former professional boxer and world champion. The 43 year old dubbed “the fighter of the decade” by the Boxing Writers Association of America {BWAA} is one of the world ‘s most famous boxers who have numerous championships and belts to his name.

For what it’s worth this resilient boxer has made his name both in the boxing ring as well as in the cryptocurrency investment circle. Although this came with a few costs, a few mistakes, one that will change the way we invest today.

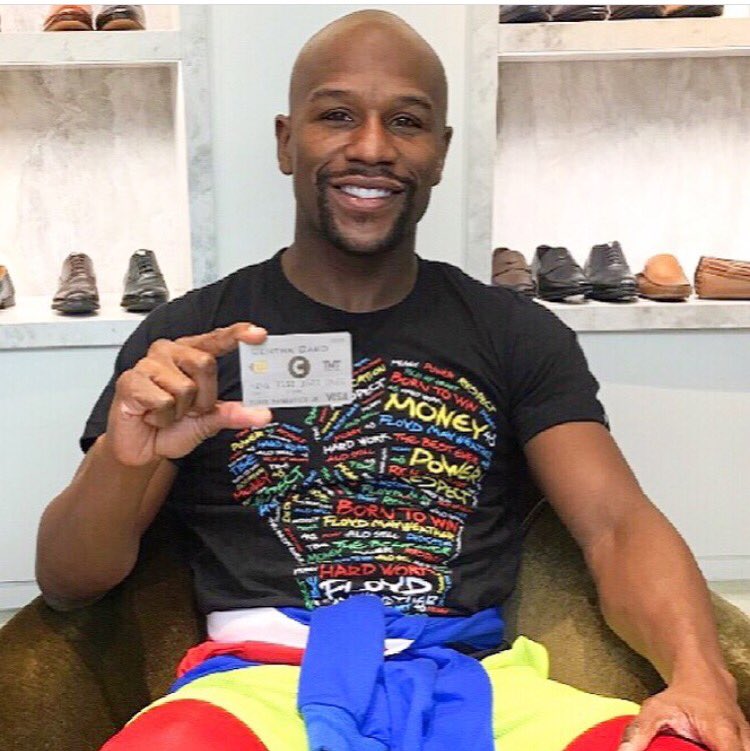

Very little was known of the case that involved the duo of Floyd Mayweather and Music producer DJ Khaled and the ensuing drama with the Security and Exchange Commission {SEC} that slammed both with $767,000 fine for unlawful touting an ICO to their followers on their social media platforms.

Floyd tweeted to his followers asking them to get into the initial coin offering of failed crypto project CENTRA hosting its security token sales disguised as utility token. A development met with stiff resistance by the regulatory bodies.

It seems to a lot of speculators at the time that Floyd Mayweather may not have collected money for promotional purposes and he may have actually bought into the project having claimed in his tweet that “He already got in” and in turn asked his over 2.2m Twitter followers to get in before the tokens get sold out. Little to nothing was released about the claims of collecting money for promotions from the Floyd team, but here is a critical analysis of what may have gone down.

Floyd’s interest in the Crypto market?

2017 was the boom period of the global cryptocurrency market which oversaw various crypto projects springing up claiming to solve one real life problem or another. The crypto sphere was agog with one new project nearly each day. It was this famous year Bitcoin made a move from $900 to whooping $20000. Ushering the crazy bull rally that had a long term correctional effect the following year.

Fact on the matter was that a lot of tokens issued, projects formed, companies created at the time were actually securities and not utilities as many falsely claimed at the time in their whitepapers and fancy websites. Regardless of the status of the project’s tokenomics, emotions at the time were at an all time high as investors weren’t known to be critical in their views nor asked critical questions. The next project was the next chance to really hit it big!

Or so they think…

Floyd Mayweather’s failure to understand the actual underlying principles that govern a project ecosystem, infrastructure, tokenomics, company structure became his undoing. Surely we could take some few lessons learnt from his mistakes.

Ask Questions

Don’t be a fanboy all the time. Without hope nothing would be achieved, positivity brings a healthy lifestyle and mindset. But to be overtly hopeful is to be exposed to potential losses in the cryptocurrency investment space. You don’t want to be losing money no matter what, which is why it’s behooves on anyone who wishes to be profitable in the sector to always ask questions.

Study the white paper and lite paper

One biggest take from the boom and crash witnessed in 2017-2018 is that a lot of investors failed to conduct their due diligence on their investment of choice. Even in the traditional investment space, failure to carefully study underlying mechanics that governs your investment is likened to loss of money. It’s the same as investing blind.

An upside to the great bear season of 2018 is that it made a lot of investors today read the various papers and ask the right questions.

Do your own research {DYOR}

DYOR is a term made common in the blockchain. Thankfully, this has made quite a lot of users and investors alike responsible for their investment choices. In fact today no matter the endorsement by any known celebrity, the chances of project failing is high when certain requirements and conditions are not up to investors expectations.

AMAs are conducted by various teams both already established and upcoming to answer critical questions asked by investors. In some cases this AMAs are consistent and no more taken lightly due to the crucial role it plays in ensuring investors confidence.

There seems to be no more involvement of the world famous boxer popularly called “The Money” by fans in any known cryptocurrency company in recent times. However it’s expected that regulation which many believe will restore the confidence of the average Joe in investing will come into full effect as the years run by.

Until then we hope to see the return of Floyd Mayweather in the cryptocurrency space with a more better approach this time.

Hope you enjoyed reading what a great influence ‘Floyd’ is for other sportsmen & women and celebrities in general. In case you would like to read our last week article on ‘Messi and Cryptocurrency’ feel free to read it here.