Crypto Highlights Week #42 – Almost 1M ETH would have burnt in the last 365 days if (EIP) 1559 had been approved

Crypto Highlights: SaTT now offers staking rewards through Uniswap, Japan’s companies take a huge leap in blockchain tech, Canada finally confirms its expectation for a CBDC and many more in this week’s crypto highlights.

Table of Contents

Top Headlines Of The Week

- 3 front runners for blockchain in Japan launched a new pilot on digital identity interoperability.

- Canada reveals plans to expedite its search for a national CBDC by hiring an economist before the end of this year whose main objective will be to prepare the country to obtain monetary sovereignty through a digital currency.

- Watch out for BTC, BNB, LTC and few more as this week’s outlook predicts major price fluctuations.

Top Stories Of The Week

JCB, Mizuho Bank Pilot a Joint Blockchain Venture on Digital Identity Management

Taking the spotlight of this week’s crypto highlights is Japan’s third-largest bank, Mizuho Bank and incumbent payment giant JCB launching a pilot project for digital identity interoperability on top of blockchain technology. Fujitsu Laboratories, the developer of the said solution announced it to the world on the 15th of Oct.

The joint venture will now present an opportunity for both companies to securely link and exchange member information across multiple operators. This includes sensitive information such as employee names, addresses and employers securely stored on a private cloud by Fujitsu. The pilot project is expected to be carried out focusing 100 Fujitsu Group employees. Mizuho plans to run the pilot till early next year.

All three organizations – Mizuho Bank, JCB and Fujitsu Group have demonstrated varied interest levels in exploring blockchain tech over the past several years.

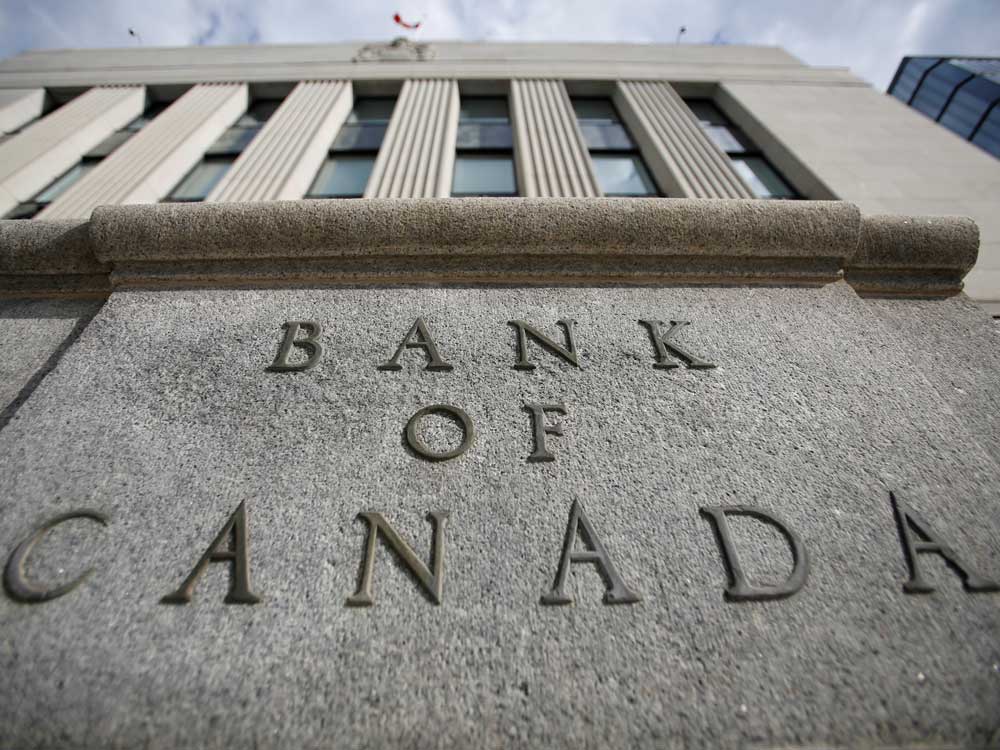

Bank of Canada hits the last nail towards a Canadian CBDC

With so much being discussed of the possibilities of the US launching a CBDC, many have overlooked its North American neighbour Canada’s possibility of launching one on its own. It is in this light, we hear that the Bank of Canada has openly expressed that it’s looking to hire an economist who has in-depth knowledge of fintech and digital currencies. Many indicate that this may be the signaling of a broader move by the National bank to launch a Canadian Central Bank Digital Currency(CBDC).

According to the bank’s official website, the economist’s duties will range from analyzing economic and policy issues related to digital currencies and Canadian monetary sovereignty, monitoring latest developments in the payment industry and providing insights to the bank’s senior management.

“A key part of this program is the monitoring framework for money and payments and the contingency planning for a central bank digital currency (CBDC). This is a program of major social significance and will require us to break new ground. “

The bank has only outlined a high level set of functional requirements which speaks of knowledge about the top-tier blockchains as well as the payment card networks and other associated entities involved in launching a new digital currency to the financial ecosystem. Applications are expected to close at the end of this week by 25th Oct. It will be very interesting to see how the public and financial experts in the country react to this.

Almost 1M ETH would have burnt in the last 365 days if (EIP) 1559 had been approved

Widely known as EIP 1559, the controversial Ethereum Improvement Proposal would have burnt 970,000 Ether (ETH) approx. 1M — amassing a total value of $360 million — in the last year, had the new proposal been implemented. The main points put forward in EIP 1559 seeks to reduce transaction fees by introducing flat fees alongside a burn mechanism.

The report published by the Head of DTC Capital Spencer Noon based on data by Dune Analytics has opened the floor to discussions among the larger Ethereum community as to why the proposal has not yet been approved. Quoting an individual who goes by the name of ‘Laur Science’ has recently suggested on Twitter, that it should come along with the next hard fork.

“Hopefully, we don’t keep discussing this for two more years while miners get too much $ETH and dump it for $USD, keeping the $ETH price in check.”

The current proposal was initially proposed way back in 2018 by Vitalik Buterin himself, that would drastically change how transaction fees are calculated. EIP-1559 proposes a ‘base fee’ for all transactions.This fee is burnt and the incentive for miners then comes from the users via a ‘tip’ added on top of the base fee.

At the same time, the proposal allows the ‘ base fee’ to be varied in order to keep block size around 10m gas. According to Vitalik, the proposal has four main design goals — increased security, predictable fees, consistent block size and concrete economy (prevent fees being paid in other tokens).

Exclusive From SaTT

SaTT delivers much awaited Staking program with unbeatable rewards on Uniswap

In the spotlight of this week’s crypto highlights is SaTT announcing its staking rewards program over the weekend. SaTT offers 2 ways for its token holders and community to join in on the staking rewards.

- Swap ETH for WSaTT

- Convert SaTT to WSaTT

A much awaited reward, almost can be considered as a way of showing gratitude for the community’s dedication and patience since it began its ICO in 2018. Once acquiring WSaTT, members can head over to Uniswap, biggest DEX on Ethereum to stake their WSaTT and increase the liquidity pool in Uniswap. This is a step by step guide describing all about how to get on Uniswap for anyone interested.

SaTT is currently listed and tradable on BW Exchange, a US-compliant exchange, ProBit Exchange, a frequent feature in top ten exchanges, WhiteBIT an EU-compliant top ten exchange on Coingecko and Coinsbit, one of the popular Eastern European exchanges. we have been on the move with each week accompanying a new exchange listing.

Token rewards will be as follows for staking WSaTT:

- 10 days : 2% – Only for the first 50 participants

- 30 days : 3%

- 90 days : 10%

- 180 days : 22%

Mainstream Adoption Of The Week

Zilliqa embraces DeFi and billions of ZIL staked in a matter of hours

Last week saw 1 billion ZIL staked in a matter of a few hours as Zilliqa launched a non-custodial staking platform on its mainnet.

Zilliqa is known for being a high-performance and secure blockchain platform for enterprises and next-gen dApps. Not long ago in June,Binance and KuCoin were announced as exchange staking partners by Zilliqa. But now the token holders have the facility to stake directly into the smart contract without having to go through a third party intermediary.

Staking will enable ZIL holders to participate in governance voting as the platform strives to become more decentralized, as well as earn rewards through staking.

According to the company, annual staking returns are estimated to be around 6%, if 80% of the circulating supply, currently 10.5 billion ZIL, is staked. This is a huge expectation of which only a 10% is achieved currently. Holders will be issued 1 gZIL for every 1,000 $ZIL earned as staking rewards. gZil is a new token introduced to the network referred to as governance ZILs, or gZIL.

This Week’s Market Sentiment

Market is expected to rise for many cryptocurrencies, however watch out for these 5: BTC, XLM, CRO, BNB, LTC

This week’s market sentiments focus on 5 major cryptocurrencies expected to demonstrate heavy market movements. They are BTC, CRO, XLM, LTC and BNB.

With recent institutional investments from major investment firms as well as from Jack Dorsey’s Square last week, BTC investments by institutional buyers have shown a significant growth last week. Data from Skew shows Bitcoin’s spot volume on LMAX Digital, an exchange that mainly caters to institutions has overtaken retail-oriented exchanges. This indicates that institutional investors could be building up positions slowly as they expect the price to move even higher in the future.

BTC price predictions

Many who bought the dip at $11, 165 anticipate a breakout at this level which may resume the upward -move with the first target at $12,000 and then $12,460.

XLM price predictions

XLM broke below the 200-day simple moving average ($0.077) on Sep. 21. but the bears could not capitalize on this move and sink the price below $0.066841. This signals buying by the bulls at lower levels. If the bulls succeed in beating $0.084584, the pair could start a new uptrend that may rally towards $0.10.

CRO price predictions

Coin (CRO) plummeted and closed (UTC time) below the $0.144743 support. This bearish setup has a target at $0.10607. The bulls might attempt to defend the 200-day SMA at $0.121 but a bounce off this level could retest the breakdown levels at $0.144743. The price may continue to go down if the sellers try to sink the price below the SMA. Very cautious period, if you own CRO.

BNB price predictions

If the buyers can thrust the BNB/USD pair above the $32– $33.3888 resistance zone, the momentum could pick up and a retest of the all-time highs. This is definitely on the cards, so watch out if you’ve invested in BNB. At the same time, Binance Coin turned down from $31.9798 on Oct. 16 but the bulls purchased the dip to the immediate support at $29.5646. This suggests that the previous resistance level has now flipped to support.

LTC price predictions

Litecoin (LTC) is attempting to form an inverse head and shoulders pattern that will complete on a breakout and close (UTC time) above $51.50. The flat moving averages and the RSI below the midpoint suggest a balance between supply and demand.

Meme Of The Week

We hope you enjoyed this week’s edition of crypto highlights. For a peek at our last edition of crypto highlights & blockchain news, click here.