Crypto Highlights Week #6 – NFT adoption doesn’t seem to be slowing down

Crypto Highlights: Blockchain VCs surged in 2021, Bitcoin renewed rally, 2016 Bitfinex hacker awakened wallet, GameStop to launch NFT marketplace: these and more in this weeks’ Crypto Highlights.

Table of Contents

Top Headlines Of The Week

- NFT adoption doesn’t seem to be slowing down as GameStop plans to launch an NFT marketplace with Ethereum Layer 2 Immutable X.

- The awakening: Bitcoin worth $2.5 billion moved by 2016 Bitfinex hackers after staying idle for a long time.

- Shift of market sentiment as crypto derivatives data signals improving investor market outlook and a possible trend reversal.

Top Stories Of The Week

Blockchain startups grow as global VC funding generated $25.2B in 2021

According to CB Insights, venture capital financing achieved new highs in each quarter of 2021, making last year an exceptional year for blockchain firms. Based on their “State Of Blockchain 2021” study, blockchain startups received $25.2 billion globally. From venture capital investment last year, a 713 percent growth from $3.1 billion in 2020.

According to the research, the United States led the way in terms of funding agreements in the fourth quarter of last year, producing $6.26 billion from 157 transactions. Thus worldwide development has been fueled by rising consumer and institutional demand for cryptocurrency-related products and services.

As a result, crypto exchanges and brokerages received $1 out of every $4 in the financing. Thus accounting for a quarter of total worldwide blockchain funding in 2021. While the biggest deals went to global crypto exchanges such as FTX; which rated as the second-largest equity deal for brokerages and exchanges in Q4 of 2021. Investment for country-specific exchanges has also been on the upswing, according to Bendtsen.

For example, CoinSwitch Kuber, one of India’s leading crypto trading platforms, placed fourth in Q4 2021 for top equality transactions for brokerages and exchanges, raising over $260 million in its latest Series C financing round. “Based on these statistics, it’s clear that we’re witnessing the globalization of cryptocurrency, as more country-specific exchanges raise spectacular rounds,” Bendtsen added.

Bitcoin worth $2.5 billion moved by 2016 Bitfinex hackers: Almost all funds now transferred

This week’s crypto highlights reminds us of the importance of strong security for cryptocurrency holdings. On Tuesday, Bitfinex hackers who stole assets from the cryptocurrency exchange in 2016 transferred a total of 64,643 bitcoins (worth approximately $2.5 billion at current values) to unknown wallets. Whale Alert followed the movements, and the funds were distributed among 21 distinct transactions. These transactions ranged in value from less than one bitcoin to 10,000 bitcoins per transaction.

Six of the 21 total transactions moved 60,000 bitcoin, with each transaction carrying 10,000 bitcoin. A total of 64,643 bitcoins have been moved to unidentified wallets.

In 2016, Bitfinex lost 119,756 bitcoins (worth $66 million at the time and roughly $5 billion at current rates). A Bitfinex official told The Block that with today’s 21 transactions, 99.9 percent of the stolen cash have now been reallocated.

Fourteen bitcoins out of the missing 119,756 bitcoins have yet to be relocated, according to the spokeswoman. Bitfinex has been attempting to retrieve the funds that were stolen. According to the spokeswoman, it has retrieved around 50 bitcoins (worth roughly $2 million at current rates).

According to the spokesman, the exchange “continues to cooperate internationally with law enforcement authorities, digital token exchanges, and wallet providers to recover the bitcoin stolen in the 2016 incident.”

This Week’s Market Sentiment

Crypto derivatives data signals improving investor sentiment and a possible trend reversal

The overall crypto market value increased by 10% to $1.68 trillion, representing a 25% rebound from the January 24 low. It’s too early to call the market bottom. However two major indicators – the first being the Tether/CNY premium. Secondly, CME futures basis have lately turned bullish, indicating that positive investor sentiment is fueling the current price rebound.

Whatever the cause behind Bitcoin’s (BTC) and Ether’s (ETH) 10% gains on Friday, the Tether (USDT) premium at OKX reached its largest level in four months. The indicator compares peer-to-peer (P2P) trading in China to the official US dollar currency.

Excessive bitcoin demand tends to push the indication over fair value, or 100%. Bearish markets, on the other hand, tend to flood Tether’s market, resulting in a 4 percent or larger discount. As a result, Friday’s surge had a huge influence on China-driven cryptocurrency markets.

To further demonstrate that the crypto market structure has improved further, traders could examine the CME’s Bitcoin futures contracts premium. The statistic contrasts longer-term futures contracts with the usual spot market pricing. When that signal fades or goes negative (backwardation), it is an alarming red flag since it signifies the presence of a bearish mood.

These fixed-calendar contracts typically trade at a modest premium, indicating that sellers are demanding more money to defer payment for a longer period. As a result, in healthy markets, 1-month futures should trade at a 0.5 percent to 1 percent annualized premium, a scenario known as contango.

Mainstream Adoption Of The Week

GameStop to launch NFT marketplace with Ethereum Layer 2 Immutable X

GameStop has teamed up with Ethereum Layer 2 network developer Immutable X to build its own NFT marketplace. They said the Immutable X-powered NFT marketplace will launch later this year on Thursday. In addition, the two firms have established a $100 million grant fund to assist developers that want to launch gaming NFT applications on the marketplace.

The award fund is denominated in Immutable X’s IMX tokens, specifically 56,209,850 tokens (worth more than $200 million at current levels, since the IMX’s price has risen in recent days). However, the fund is limited to $100 million.

Immutable X will also award GameStop with up to $150 million in IMX tokens if certain milestones are met. These milestones include the introduction of the NFT marketplace, hitting $1.5 billion in sales volume and $3 billion in sales volume on Immutable X within a specific time frame.

Immutable X is a Layer 2 Ethereum network designed exclusively for NFTs. It uses StarkWare’s ZK-rollup technology and offers “instant trade confirmation, massive scalability, and zero gas fees.”

Exclusive From SaTT

With Simplex, buying SaTT has never been easier!

Did you Wonder? How can we as influencers, businesses make SaTT the advertising token if it is only freely available to crypto insiders? By making it easier to buy! We incorporated Simplex into our website with this goal in mind. The results are clearer now: purchasing SaTT has never been easier!

Simplex is a payment solution that allows you to easily buy your favorite cryptocurrencies directly by credit card. Today, SaTT joins the long list of tokens supported by Simplex, allowing everyone to buy it via credit card directly from our website or Simplex website.

To ensure the best pricing, the liquidity utilized for the purchase is the SATT/USDT pair of the Bittrex exchange, where we have been listed since November 4th.

SaTT continues to determine the course of blockchain advertising with the integration of Simplex. Year 2022 is already shaping up to be a jam-packed year for SaTT with fresh breakthroughs.

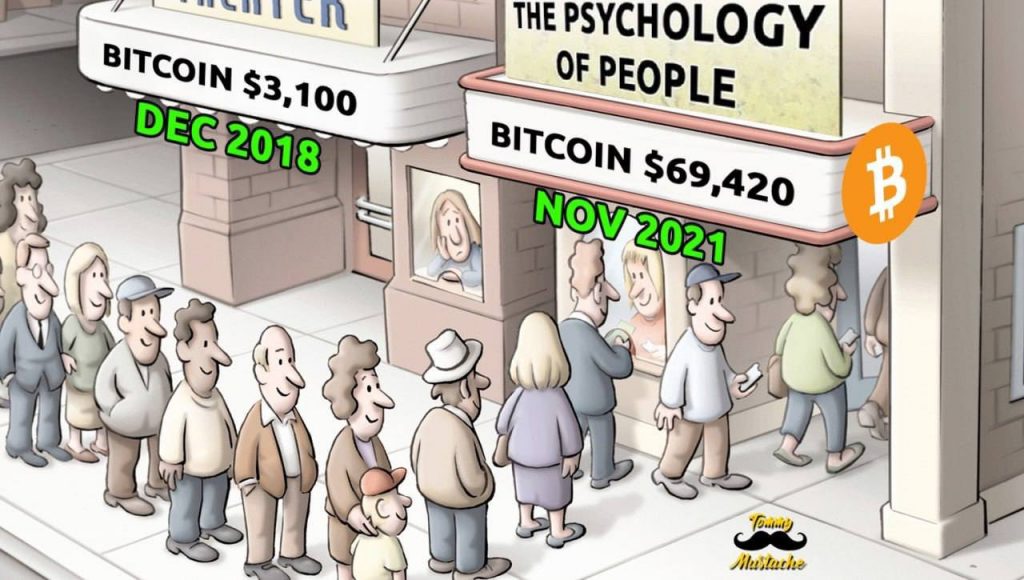

This Week’s Crypto Meme

We hope you enjoyed this week’s edition of crypto highlights. For a peek at our last edition of crypto highlights & blockchain news, click here.