Crypto Highlights Week #20 – DBS Bank Joins Blockchain Network Contour to Digitize Trade Settlement

Crypto Highlights: TON abandoned, JPMorgan and Coinbase alliance, SaTT now rewriting crypto bounty narratives, Crypto education, China recognition for blockchain jobs, these and more in this week’s crypto highlights.

- Crypto bounty campaigns have struggled in serving as a viable advertising model in the crypto space but have failed to hold enough waters; all of this is fast changing as SaTT steps into the scene.

- Telegram’s TON blockchain losses steam and call it a quit after the SEC won a preliminary injunction in the U.S court to bar Telegram from launching TON or distributing its gram tokens.

- Bitcoin has scored a hard trick in its safe-haven narratives as the digital asset has outperformed gold by almost tripling the price performance of gold amidst the rising global economic downturn.

Table of Contents

Top Stories Of The Week

JPMorgan Opens Accounts For Bitcoin Exchanges — Coinbase And Gemini Up First

The race for crypto adoption keeps marching north as traditional financial institutions are now raising support for Bitcoin-related deposits. In the latest development, major banks in the United States, JPMorgan now offer bank accounts to Gemini and Coinbase cryptocurrency exchanges.

The relationship between the bank and the duo was sealed last month. In its agreement, the $2.6 trillion banks will provide deposit, withdrawal, and transfer services for Coinbase and Gemini customers with Automated Clearing House (ACH) infrastructure.

Establishing a relationship between crypto exchanges and banks has been an uphill task in the past due to scam-related crypto activities and intense regulations, however, it looks like all these are changing now as crypto continues to gain mainstream adoption and wide range acceptance.

Telegram Abandons TON Blockchain Project After Court Fight With SEC

The TON blockchain project goes cold after two years of the legal battle between Telegram’s TON network and the United States SEC. Telegram founder Pavel Durov wrote in his public channel on Tuesday that the Telegram Open Network (TON) project would be discontinued due to the company’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC).

This drastic decision comes as a big shock to investors as the Telegram’s TON network had been anticipated to launch in 2021. A blog post has it that the decision was necessary after the SEC won a preliminary injunction in the U.S court to bar Telegram from launching TON or distributing its gram tokens.

Telegram has stated its decision to reimburse all investors about 72% of their funds back immediately, or they could choose to wait for one year and receive 110% of their initial investment.

DBS Bank Joins Blockchain Network Contour to Digitize Trade Settlement

The relevance of blockchain in the financial institution cannot be ignored anymore as Contour’s ecosystem of banks continues to grow ahead of the blockchain platform’s full launch later this year. DBS Bank becomes the first Singaporean bank to join the Contour trade-finance blockchain network, which is built on R3’s Corda and digitalizes global trade processes. This steals the last spot on last week’s crypto highlights.

While stating its reason behind the recent move, DBS bank had reiterated that ‘contact-free’ banking is steadily becoming an everyday necessity and the world continues to digitized especially in the face of this covid-19 pandemic.

With the recent move, DBS will be able to leverage the digital solution to fully digital end-to-end LC settlement process, including the transfer of electronic trade and title documents.

More News Updates From This Week

SaTT Is Establishing Global Presence as The Blockchain Way of Monetizing Social Media Content for Bounty Campaigns

SaTT was the key highlight of a recent media publication on the entrepreneur.com. The publishers/followers of a social media campaign will no longer be subjected to a manual reward system, once entries into a campaign have been approved, the SaTT smart contract executes the reward for each entry based on the performance of the content.

Cryptocurrency bounty campaigns have become one of the popular ways of advertising blockchain projects, however, due to the bottlenecks rocking the campaign style, the model is fast losing steam. It costs a lot of money to employ the services of a bounty manager, and most time their inefficiencies render the effort of the bounty hunter into a fruitless venture.

Errors in compiling rewards, inadequate compensation, and a biased reward system stand tall among the reasons why bounty hunters have shied away from hunting. But this is set to change as SaTT platform goes live to enable blockchain projects to directly create and execute bounty campaigns in a decentralized environment without the need for any third party (bounty manager) at a pocket-friendly cost.

From a bounty hunter’s perspective, the SaTT solution raises the bar above most barriers that have kept them away from hunting.

A Popular Study Shows Communication and Education Are Key to Building Trust in Crypto

As the world braces for cryptocurrency adoption, there is a larger population of people who probably haven’t heard or read any pieces with a cryptocurrency narrative. While most people who might be aware of the concept of cryptocurrency may lack fundamental knowledge and uses of crypto digital assets.

While this remains true, a recent study revealed that three out of four people surveyed among two million respondents are not familiar with cryptos and blockchain technology. The study had concluded that the more people know about crypto, the more they see the potential for the positive impact they can have.

To increase crypto education, crypto companies hold the bigger responsibility of raising awareness and educating the general public about the importance and use case of crypto and blockchain in contemporary society.

Major Adoption Of The Week

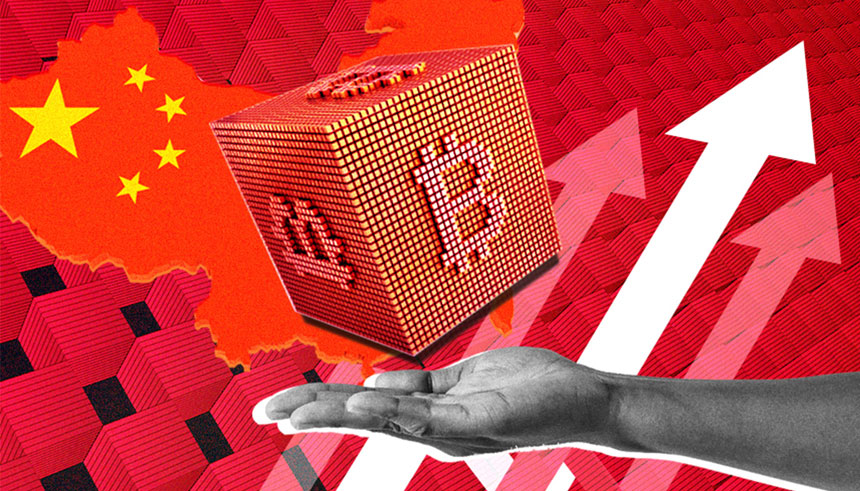

China Officially Recognizes Blockchain Jobs as New Occupation

The current global covid-19 pandemic has disrupted economic activities and has affected the normal way of doing things. Amidst this disruption, there is still a positive side to the story as the world braces up to recognize the relevance of a decentralized workforce powered by blockchain.

Blockchain-related jobs have been on the rise and increasingly popular despite the current pandemic. In light of this, China is taking another giant step toward blockchain adoption to officially recognize blockchain jobs as industry jobs.

According to a May 11 statement by the MOHRSS, blockchain-focused professions, like tech developers, engineers, and analysts, are among the 10 newly recognized jobs. It’s no longer news that China is leading the global pace in blockchain adoption with its numerous blockchain patents. This move is however considered as a giant step in the right direction.

Major Crypto Market Sentiment

Bitcoin Doubling Gold’s Yearly Gain So Far

The industry comparison between gold vs Bitcoin’s investment is not yet of the book. Though most crypto proponents have fondly referred to Bitcoin as digital gold, however, the argument that Bitcoin is far better than gold is becoming clearer both in the short and long term perspective.

Amid unstable global financial conditions, Bitcoin continues its path as a juicy-looking hedge asset, based on its gains comparative to gold. Bitcoin has reported over 30% gains for the trading year as opposed to gold which has managed to return a 12% gain.

Bitcoin is now witnessing a surge in mainstream interest as most institutional players are beginning to see the bright side of the digital asset. In the just concluded week, hedge fund manager Paul Tudor Jones had announced that 1% of his portfolio has been invested in Bitcoin. As the new week opens, investors are looking at the upside as Bitcoin is poised for more gains.

This Week’s Crypto Meme

We hope you enjoyed this piece on last week’s crypto highlights. For a peek at the last week digest of crypto highlights & blockchain news, click here.