A Guide To Crypto Slang: 19 Terms Every Beginner Should Know

Table of Contents

Introduction

Are you new to the world of cryptocurrency? There’s a lot to learn when it comes to understanding the terminology used in this space. From FOMO to HODL, crypto slang can be hard to follow if you don’t know what the terms mean. Fear not, as this guide will provide you with a comprehensive overview of the 19 most important terms that every beginner should know. From trading terms to industry-specific words, you’ll be able to easily navigate the crypto world and confidently participate in conversations. So, without further ado, let’s dive into the world of crypto slang and learn more about SaTT.

Crypto Slang n°1: Whale

A whale, in the context of crypto, is a trader or investor with a large amount of capital. The amount required to be considered a whale depends on the individual crypto asset. For example, to be considered a whale in the bitcoin markets, you would need to hold a net long position worth approximately $100,000,000. Whales are generally believed to influence the price of an asset through their trading activity. This can take the form of buying or selling large amounts of an asset, which has the potential to significantly affect the price. Although whales generally have a positive impact on the price of an asset, particularly in the short term, there are also negative implications for the long term growth of the industry. In order to prevent the price of an asset from being manipulated by whales, several exchanges have implemented restrictions. For example, Binance has a restriction on the number of tokens that one person can sell in a given period.

Crypto Slang n°2: FOMO

FOMO stands for “fear of missing out” and is a common phrase that is used in the crypto world. It denotes the anxiety of not being involved in a particular event or investment, which can often be driven by speculative and impulsive behavior. When it comes to the crypto world, FOMO often manifests itself in the form of regret. For example, you may wish you had bought bitcoin when it was $20,000 instead of waiting for the price to drop to $3,000. FOMO can be a good thing, as it can lead you to make smart decisions. However, it is important to note that investing based solely on FOMO can result in impulsive and regretful decisions. Therefore, you should only invest in crypto if you truly believe in the asset you are acquiring and can make a strong case for why it will increase in value.

Crypto Slang n°3: HODL

HODL is a term that originated in a forum post on the BitcoinTalk forum, where a user wrote “I am still HODLing” when the price of Bitcoin was crashing. Initially, this term was used to describe investors who didn’t panic sell during a correction and instead decided to hold their investments until the prices recovered. However, over time this term became associated with any person who invested in cryptocurrencies and didn’t sell their holdings no matter what the market conditions were. The term HODL can be used to describe both short-term and long-term investors, while the short-term HODLers are the ones that buy in times of uncertainty, hold until the market stabilizes and then sell. On the other hand, long-term HODLers are those who buy when the market is low and sell when the prices are high.

Crypto Slang n°4: ATH

ATH stands for “all-time high.” In the context of cryptocurrency, it refers to the highest price that a particular cryptocurrency has ever reached. For example, if the price of Bitcoin reached a new all-time high of $50,000, it would be considered an ATH for that cryptocurrency. ATH is a term that is commonly used in the cryptocurrency market to refer to the peak price of a particular coin or token. It is also used as a measure of market performance, as a rising ATH can indicate strong demand for a particular cryptocurrency.

Crypto Slang n°5: Bullish

Bullish is a term used in the world of finance and investing to describe an optimistic outlook or positive sentiment about a particular market or asset. In the context of cryptocurrency, a bullish sentiment refers to a belief that the price of a particular cryptocurrency will rise in the future. This can be based on various factors, such as positive news about the underlying technology, a strong market demand for the cryptocurrency, or the belief that the market is undervalued. Investors who are bullish on a particular cryptocurrency may be more likely to buy and hold it, in the hope of making a profit when the price increases.

Crypto Slang n°6: Bearish

Bearish is a term used in the world of finance and investing to describe a pessimistic outlook or negative sentiment about a particular market or asset. In the context of cryptocurrency, a bearish sentiment refers to a belief that the price of a particular cryptocurrency will fall in the future. This can be based on various factors, such as negative news about the underlying technology, a weak market demand for the cryptocurrency, or the belief that the market is overvalued. Investors who are bearish on a particular cryptocurrency may be more likely to sell it, in the hope of avoiding potential losses if the price decreases.

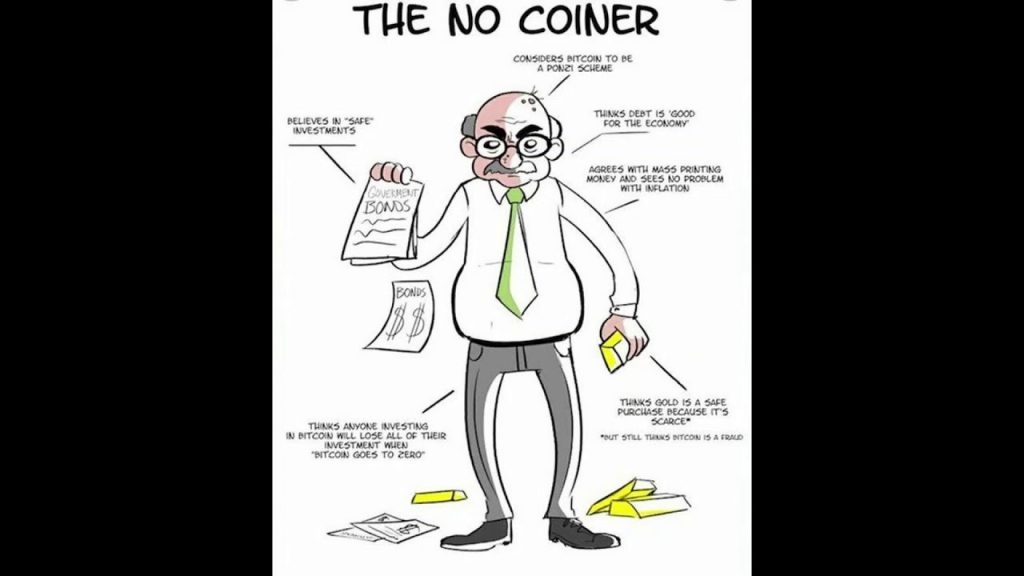

Crypto Slang n°7: No-coiner

You might encounter people who are skeptical about cryptocurrency, or no-coiners, in the crypto community. Don’t get upset or offended by their comments as it’s all just good-natured ribbing. This is just a way for the crypto community to poke fun at people who don’t really understand the potential of cryptocurrencies or who desperately try to find flaws in the blockchain technology. The no-coiners are often seen as the “anti-thesis” of the crypto community. They are the people who spread FUD (Fear, uncertainty and doubt) about the crypto world and try to shut it down. If you meet someone who fits this description, don’t be defensive — just have fun with it!

Crypto Slang n°8: SHILL

Shill is a term used to describe someone who promotes a particular product or service in a deceptive or overly enthusiastic manner. In the context of cryptocurrency, a shill is someone who tries to artificially inflate the demand for a particular coin or token by making false or exaggerated claims about its potential value or usefulness. This can be done for various reasons, such as to manipulate the market or to profit from the resulting price increase. Shilling is generally considered to be a dishonest and unethical practice, and it is illegal in many countries.

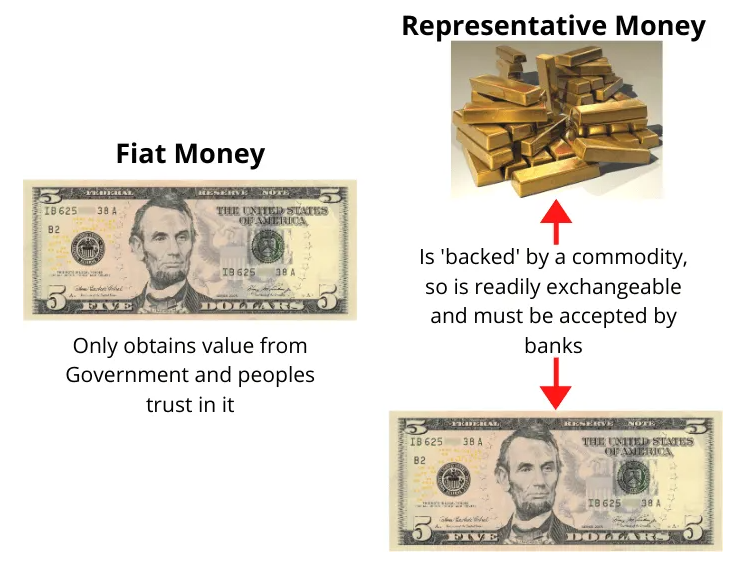

Crypto Slang n°9: FIAT

FIAT is a term used to describe traditional currencies, such as the US dollar or the euro, that are issued by a government and backed by physical assets such as gold or silver. Crypto, short for cryptocurrency, is a digital asset designed to work as a medium of exchange using cryptography to secure financial transactions, verify the transfer of assets, and control the creation of new units. In other words, FIAT is a type of physical currency, while crypto is a type of digital currency. While they are different in many ways, both FIAT and crypto can be used as a means of exchange for goods and services.

Crypto Slang n°10: Normie

As the world of blockchain technology and cryptocurrencies becomes more and more mainstream, the crypto community is starting to see an influx of “normies” — people who have no knowledge or interest in this field and just want to make money. They are often associated with people who are running shady ICOs, but in reality, there are many legitimate ICOs that also have a large proportion of normies. The crypto community often associates normies with people who don’t really understand the space, have no interest in learning about it, and just want to make quick money. As such, the crypto community likes to poke fun at them for not understanding the basics of blockchain technology or the concepts behind it.

Crypto Slang n°11: Rug Pull

Rug pull or rug-pulling is a term that describes the act of deceiving someone or tricking them into participating in an ICO or making a bad investment decision. You can either make false promises to investors or pitch them with unrealistic/unreachable milestones in exchange for their money or promise them guaranteed high returns. You can also “pull the rug” from under someone by selling them a token that’s high in risk and low in reward.

Crypto Slang n°12: Rekt

Rekt is short for “rectifying”, which refers to the act of correcting mistakes, errors, or misinformation. This term is mostly associated with ICOs, where investors use it to describe the act of correcting mistakes, bad information, or false promises made in the white paper.

Crypto Slang n°13: Weak Hands

Weak hands are investors who are easily influenced by FUD and constantly sell their holdings as soon as the market turns bearish. Weak hands are mostly associated with people who don’t really understand the concept of long-term investing or the volatility of the cryptocurrency market. That being said, weak hands aren’t always bad — sometimes they play their role of “clearing the market” and removing the weak hands from the market by selling their holdings and providing liquidity to the market.

Crypto Slang n°14: When Lambo?

When Lambo? Is a term used to poke fun at the impatience of someone who wants to make a quick buck by investing in cryptocurrencies. This term is often used jokingly by the crypto community and refers to the hope that they’ll be able to sell their crypto investments and make enough money to buy a Lamborghini. The term is mostly used as a way to poke fun at people who are impatient and want to make money right away. If you hear someone asking you “when Lambo?”, they’re likely joking around and not actually expecting an answer.

Crypto Slang n°15: DYOR

DYOR stands for “do your own research” and is a common recommendation given to crypto investors. It is used to encourage individuals to do their own research when they are considering investing in an asset. This is because, unlike the traditional financial markets, there are very few regulated crypto exchanges and assets that have been approved by an authorized regulatory authority. As a result, it can be difficult to verify the legitimacy of assets and trades taking place in the crypto space. Therefore, it is important to conduct your own research and cross-reference information to verify that what you are reading is accurate.

Crypto Slang n°16: FUD

FUD stands for “fear, uncertainty, and doubt” and is used in the crypto world to denote negative or misleading information about an investment. For example, if a particular trader were to say that bitcoin is a scam and that you should not buy it, this would be considered FUD. FUD is particularly noteworthy in the crypto space due to its unregulated nature. Unlike the traditional financial markets, there is no central authority that can regulate the flow of information in the crypto world. As a result, it can be difficult to determine what is real information and what is false information. Moreover, it is relatively easy for traders to make an exchange account appear legitimate, which means it can be difficult to determine the legitimacy of information.

Crypto Slang n°17: IYKYK

This acronym stands for “if you know what you’re doing,” and is used when someone is confident in their actions or advice. It is common to hear this in the crypto community when someone is advising another trader or investor on what they should do. In this context, the phrase “if you know what you’re doing” is used to denote that the advice is only applicable to someone who is knowledgeable about the crypto space and its associated risks.

Crypto Slang n°18: Moon

The term “moon” is used by traders when they wish a particular crypto asset would increase in value dramatically. It is commonly used with smaller cap coins that have the potential to increase their value by many multiples in a short period of time. For example, if a crypto trader were to say, “I hope this crypto goes to the moon,” it means that he or she wishes for the crypto to dramatically increase in value.

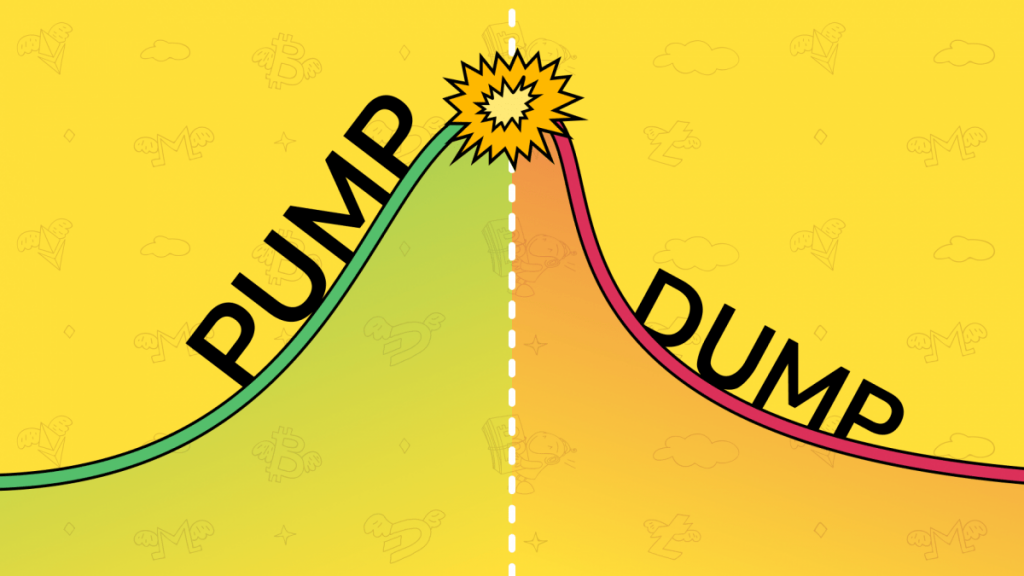

Crypto Slang n°19: Pump and Dump

A pump and dump is a type of market manipulation that occurs in almost all unregulated markets, including the crypto space. A group of traders will purchase an asset and hype it up to create artificial demand. This will cause the price of the asset to increase dramatically, which will then prompt other traders to buy in and profit off of the price increase. Once the traders who initiated the pump have sold their position and profited, they will try to create negative sentiment regarding the asset, which will prompt other traders to sell their position, causing the price to drop dramatically. Traders who bought the asset at the peak will suffer heavy losses, while the traders who initiated the pump and dump have already profited from their actions.

Conclusion

The crypto space is an exciting area to be involved in, but it can also be extremely confusing for newcomers to the industry. With so many new terms and acronyms being used, it can be hard to know what it all means. However, if you understand the terms listed in this article, you will be able to navigate the crypto space with ease and confidence. From whale to pump and dump, these are the terms you need to know to succeed in the crypto world and take part of the Post2Earn revolution.