What is an AMM Crypto?

Cryptocurrencies have been growing a lot over the last decade. In 2021, the crypto market had a value of over more than $2.9 trillion. Even so, the industry, alongside elements such as AMM Crypto, is still expected to grow.

With that said, there are certain things to note if you wish to enter the world of crypto yourself. For starters, it may be helpful to learn what Automated Market Makers are and how they work.

The article ahead will go over AMM crypto and the AMM crypto meaning. It will also go over how resourceful they can be for investors and regular individuals alike.

Table of Contents

What are Automatic Market Makers?

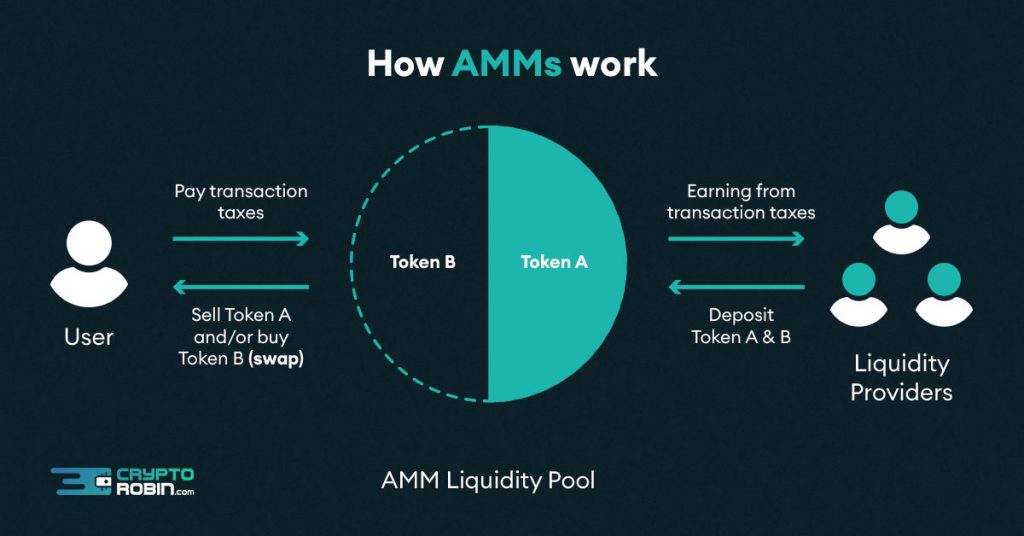

Moving to the AMM meaning crypto, Automatic Market Makers (AMMs) are complex algorithms. They act as a proxy for traders in financial markets. AMMs also function as market makers that provide liquidity to the markets.

AMM meaning crypto indicates that it’s a trading algorithm that can help make trading easier. They also help avoid the pitfalls of human traders by using a set of rules which can be programmed into the system. AMMs are usually computerized and automated. In this way, they do not need human intervention for operation.

The role of an automatic market maker is to provide liquidity for the exchange. This means that they are always there to buy or sell a commodity at any given time. They do this by buying or selling the commodity to keep its price stable. For example, if a commodity is expected to go up, then an AMM buys it and vice versa.

How Do Automatic Market Makers Work?

With regards to the AMM crypto meaning, it is a set of algorithms. In this way, it helps make decisions on behalf of the trader and execute trades at the pace and style they specify. The trader can set their AMM to be either conservative or aggressive. Conservative traders have lower risk tolerance. Hence, the software will not take as many risks as aggressive traders.

Yet, amm meaning crypto showcases that aggressive traders are likely to take more risks. But they will have the potential for higher returns on their trades. Automatic market makers are a type of algorithm used by stock exchanges. They are often used in conjunction with electronic trading systems.

An automatic market maker will buy or sell stocks when there is not enough liquidity in the market. They will also take care of any trades that are not matched. Other than that, they can even place or execute trades by themselves so that you don’t have to.

An AMM is a type of algorithm that is used to manage the cryptocurrency portfolio. It does this by using mathematical modeling and statistical analysis. This helps in deciding which cryptocurrencies are worth trading at any given time. The main goal of an AMM is to reduce the risk of crypto investment by diversifying the assets in a portfolio.

Do Automatic Market Makers Provide an Opportunity for Investors to Grow?

Automatic Market Makers are set to buy and sell stocks at a set frequency. They can be set to buy or sell once every second or once every minute, or once every few hours. The idea is that if the market maker’s algorithm is more sophisticated than the market, it will profit from the difference.

But there are many risks associated with automatic market makers. In this way, it is important for investors to be aware of what they are getting into before they start investing.

The main goal of automatic market makers is to provide liquidity at all times. This may help make trades easier. AMM Crypto also allows investors to grow through the use of a token. The token, Smart Advertising Transaction Token (SaTT), can be quite helpful.

You can trade these tokens with Ethereum. By doing so, you can ensure that you’re paid for your tweets and or videos alike. SaTT can be a helpful source of generating passive income for investors. These tokens are available for purchase on one the biggest decentralized exchange platforms as well, known by many as PancakeSwap.

Often Asked Questions

How does a AMM Crypto work?

An AMM Crypto works in two ways. It helps you find coins with high potential for growth. And, it helps you find undervalued coins that are buyable at a cheaper rate. In order for an AMM to do this, it uses a variety of tools such as different AI-based optimization algorithms.

An AMM Crypto works by following instructions given by the trader. These instructions can be set during pre-set time intervals. This is usually within every five minutes. The instructions could vary between buying/selling/holding with a specific price limit.

Is Binance an Automated Market Maker?

The Binance platform was created to provide a more efficient and user-friendly exchange. The company uses its own cryptocurrency, Binance Coin (BNB). BNB helps provide discounts on trades for the exchange.

Yet, Binance is not a traditional automated market maker. It does not use algorithms to trade on Binance’s platform itself.

Binance does not use bots or other automated software platforms. These bots are often designed to make trades in an unregulated manner. Binance is a cryptocurrency exchange that offers a wide range of coins and tokens. But it also provides its own coin, which in itself is a trading instrument.

What kind of opportunities do Automated Market Makers provide?

Automated Market Makers provide opportunities for investors in different ways. One way is that they can help endorse arbitrage between markets. The other way is that they can provide liquidity for less liquid markets or instruments.

Conclusion

Automated Market Makers have been around for decades. They have been used in the past to trade stocks, futures, and other financial instruments. Now, retail traders are using them as well as institutional traders. With that said, you might now be aware of what the amm crypto meaning is.

If you are looking to grow with Automated Market Makers, you can look into how SaTT works. This is because passive income is deemed as one of the best ways to grow your income at a rapid pace. To grow your income using cryptocurrencies, trade SaTT with ETH now.